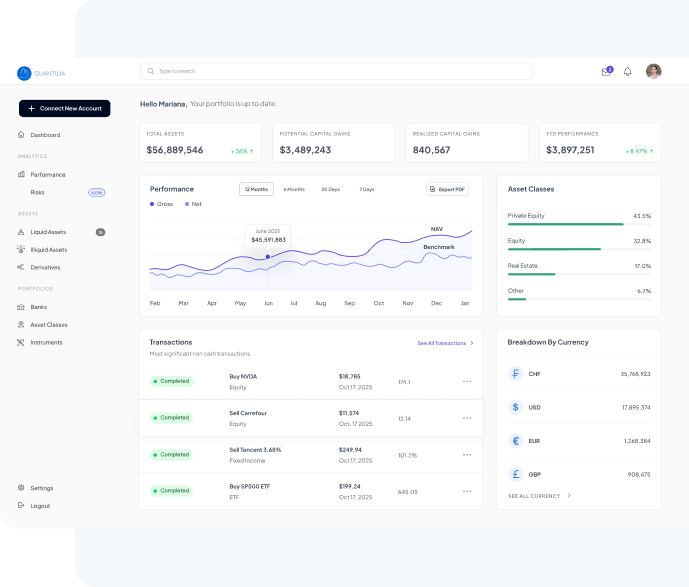

Data-Driven Portfolio Reporting Platform

Clarity in Complexity

We transform fragmented portfolio data into unified, actionable reporting—across all asset classes.

More than 200+ companies trust us wordwide

50+

Clients

$ 250B

Monitored

- 650+

Data partners

- 98%

Client satisfaction

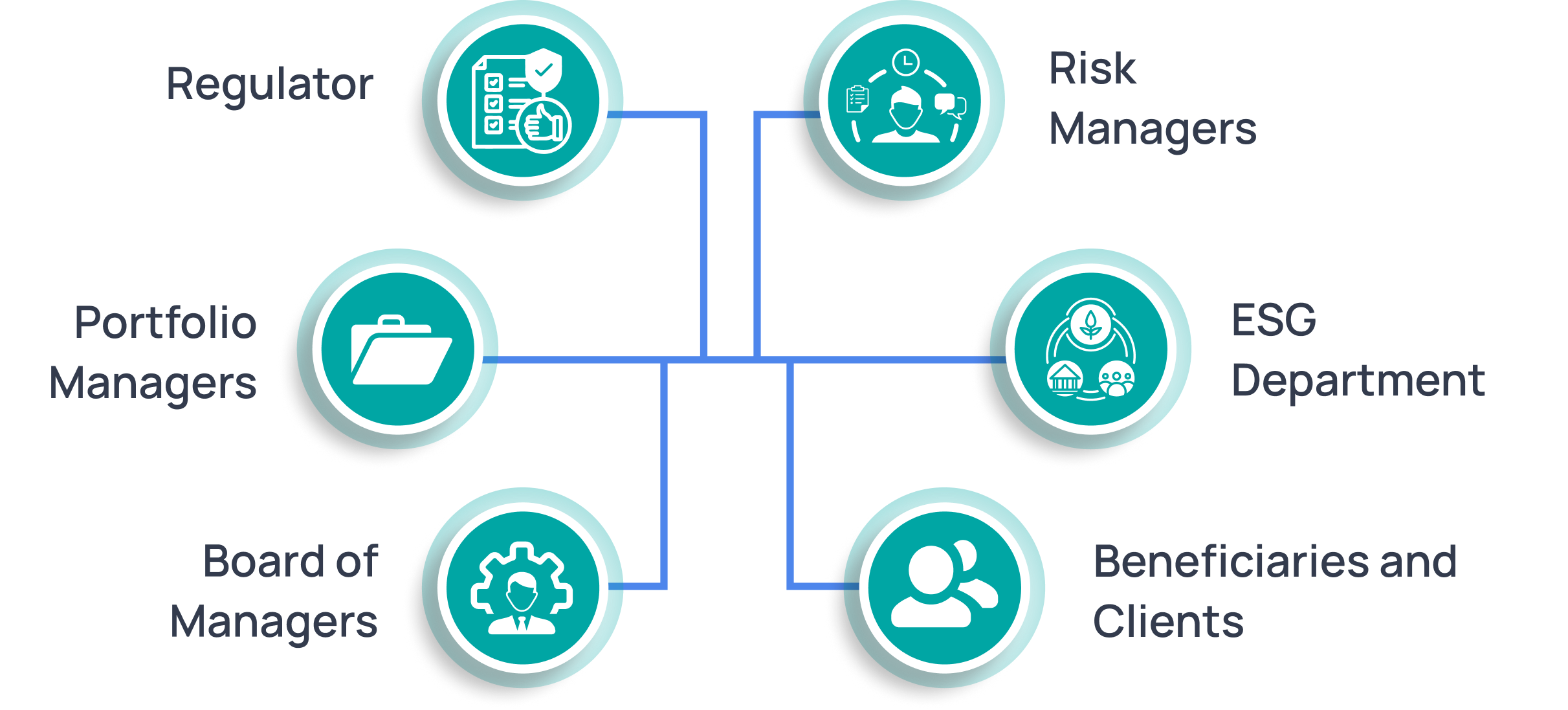

Who We Serve

- billion euro fund -> multi-manager institutional portfolio . complex multi-manager structure ->

- complex single family portfoliontilia adapts to you.

Institutional Investors

Family Offices

Asset Managers

Insurance Companies

Private Banks

Foundations & Endowments

From Chaos to Clarity

Aggregate your financial data. Then activate it.

Ingest from any Source

Custodian banks

Fund managers

Private equity & real estate

ESG providers

Excel / CSV

APIs & data feeds

- Categorize

- Test

- Enrich

- Analyse

Put it to Work

Visualize holdings & risk

Fund Automate reporting (SFDR, PAI)

Track ESG & carbon exposure

Forecast & stress-test

Share with board / auditors / clients

What You Can Do

Some of Our Core Features

Discover the key features that make our CRM -> platform powerful, efficient, and user-friendly.

Banking data consolidation

Consolidate data from all your banks and partners

Security-level Look Through

Categorize all flows, calculate ratios, forecast your liquidity needs and report on your illiquid assets positions

Private Equity analysis

Drill down into every holding for complete portfolio transparency and deeper insight.

ESG reporting

From tailor-made dashboards to regulatory reports (SFDR, PAI, LEC29,…)

Clients Feedbacks

TESTIMONIALs

What people say about about QUANTILIA

Hear directly from our clients about their experience and the impact we’ve made. Real stories, real result see how we’ve helped them succeed.

I am thoroughly impressed with GUMMBEAR’s delightful treats! The combination of great taste and a commitment to wellness truly sets them apart. My go-to for a guilt-free, joyful indulgence!

Jonathan Vallem

New york, USA

I am thoroughly impressed with GUMMBEAR’s delightful treats! The combination of great taste and a commitment to wellness truly sets them apart. My go-to for a guilt-free, joyful indulgence!

Jonathan Vallem

New york, USA

Complete. Reliable. Secure.

Industry-leading standards tailored to your needs.

ISO-27001 certified

Maximum data security.

GDPR

Full privacy compliance.

EU and Swiss based hosting

Your data stays local.

DORA Compliant

Trusted. Reliable. Secure.

Case Studies

Explore our case studies to see how businesses like yours achieved success using our platform

60% less audit prep time

How a pension fund automated its SFDR reporting with Quantilia.

Full lookthrough on 200+ funds

How a multi-family office scaled its data clarity in 3 weeks.

Real-time ESG tracking

How an insurer integrated impact metrics across its mandates.

They talk about us