Multi-Sources Data Aggregation

Connect, consolidate, and control all your investment data. Quantilia automates financial data aggregation from multiple sources—so you can focus on analysis, not manual collection.

Data Harmony

Bringing all sources into one view

Our DNA: Bridging Data Sources into One Reliable Database

At Quantilia, we specialize in integrating financial data from diverse, often fragmented sources—global custodians, private equity GPs, asset managers, fund administrators, ESG providers, benchmark vendors, and public datasets. Each of these sources may have its own format, naming conventions, and update frequency—but we believe investors should not have to compromise on data quality because of structural complexity. Our core belief is simple: good investment decisions require complete, consistent, and trustworthy data. That’s why our technology is designed not just to collect data, but to transform it into a structured and coherent database that can be relied on for performance attribution, risk monitoring, private market analytics, ESG tracking, and regulatory reporting. We don’t just build connections—we create clarity. Whether you’re consolidating data across 5 or 50 providers, Quantilia becomes the infrastructure that gives you control over your information flow, and the confidence to use it.

What the Service Covers

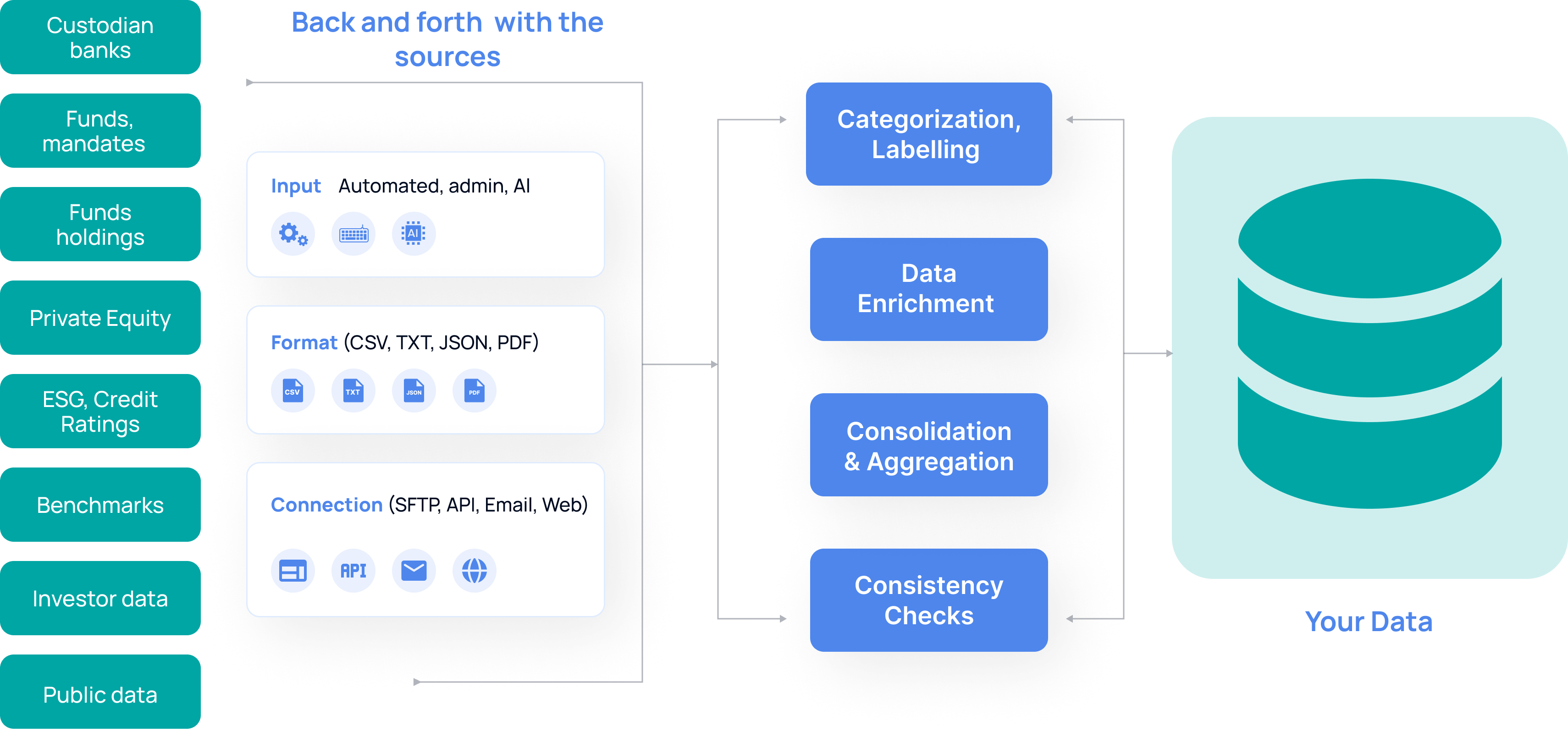

Our multi-source data aggregation engine helps you build a central database of your investment universe with precision and reliability:

Connection to over 450 pre-built data pipelines (custodians, GPs, AMs, benchmark providers)

Support for all asset classes: listed and unlisted, direct and indirect

Automated ingestion from SFTP, secure emails, APIs, or admin logins

Standardization of formats, field names, and reference data

Enrichment with external datasets (ESG scores, credit ratings, classifications)

Reconciliation checks and automated validation rules

Time-stamping, audit trail, and change tracking

Output as files, dashboards, or API feeds for downstream systems

Our Mission: A Database You Can Trust

Your database should be your single source of truth. At Quantilia, our mission is to help you build and maintain a dataset that is complete, up to date, correct, and homogeneous—no matter how many data providers or asset classes are involved. We unify heterogeneous inputs into one coherent structure, applying data quality controls at every step: missing data detection, duplicate checks, cross-field validations, and source prioritization. Enrichment layers help enhance context, such as ISIN tagging, ESG scores, or sector classification. We don’t just gather data—we prepare it for direct use in your portfolio reporting, risk monitoring, or regulatory filings.

Built to Work with All Your Data Sources

Quantilia adapts to your existing ecosystem—whether you work with global custodians, boutique GPs, third-party data vendors, or internal databases. We configure each connector to match your structure and constraints.

Custodian Banks

Automate retrieval of positions and transactions.

We connect with your custodians to retrieve daily or monthly data feeds. This includes holdings, transactions, valuations, and cash balances in a clean, ready-to-use format.

Private Equity GPs and Administrators

Capture the full picture of private markets.

From capital account statements to holdings files and notices, Quantilia extracts and processes GP-provided data to feed your private equity monitoring and reporting systems.

Benchmarks and Ratings Agencies

Add context and comparability to your portfolios.

We plug into benchmark providers (MSCI, Bloomberg, etc.) and credit rating agencies to enrich your holdings with risk scores, classifications, and reference data.

Public Sources and Open Data

Leverage free and reliable external information.

Our platform aggregates ESG disclosures, fund documents, or regulatory filings from public sources, helping you fill gaps or cross-check data from other providers.

Our Others Services

ESG Data Integration

Exposure Monitoring

Performance

Custom API

We Handle the Hassle of Data Collection and Preparation

Managing dozens of data sources is time-consuming, error-prone, and costly. That’s why Quantilia offers a fully managed service to collect, clean, structure, and enrich your investment data. We liaise directly with providers when needed, monitor data flows daily, and proactively alert you in case of anomalies. Our team handles the operational complexity—so your teams can spend more time on high-value analysis and decision-making. Whether for monthly reports, strategic dashboards, or regulatory outputs, your data is delivered on time, in the right format, and with full confidence in its quality.