Private Markets Reports

Consolidated reporting and analytics for your private market investments. From commitments to performance, Quantilia brings transparency to the most opaque asset classes.

Private Insight

Bring transparency to private assets

Our Perspective on Private Markets

At Quantilia, we see private markets not as a reporting challenge—but as a core investment pillar that deserves structured, high-quality analytics. We enable investors to monitor and report on private equity, private debt, infrastructure, and other alternatives as rigorously as they do for listed assets.

Private Markets at Quantilia

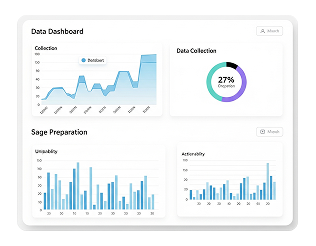

Our Private Markets Reports module brings full visibility and control over your illiquid investments through automation and expert configuration:

Aggregation of all private market positions across custodians and direct holdings

Monitoring of capital calls, distributions, and remaining commitments

Cash flow forecast modeling and liquidity analysis

Extraction of terms from PDF notices using AI and text parsing

Integration of performance data from GPs or administrators

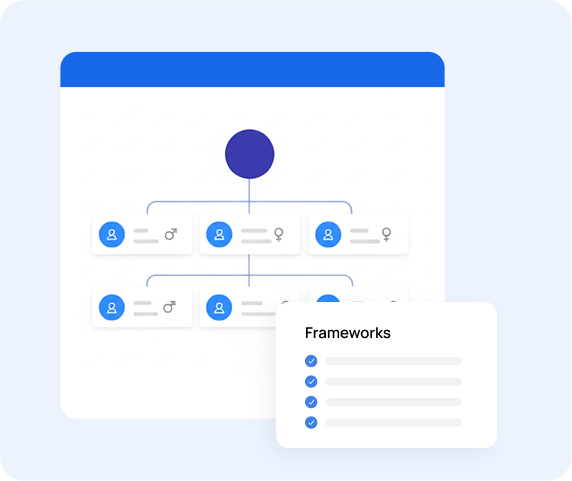

Lookthrough of private equity funds and fund of funds

Normalization of asset classes: VC, infra, private debt, real estate, forestry, art collections

Reporting packages and dashboards ready for internal or client use

Our Mission: Onboard 100% of Your Assets

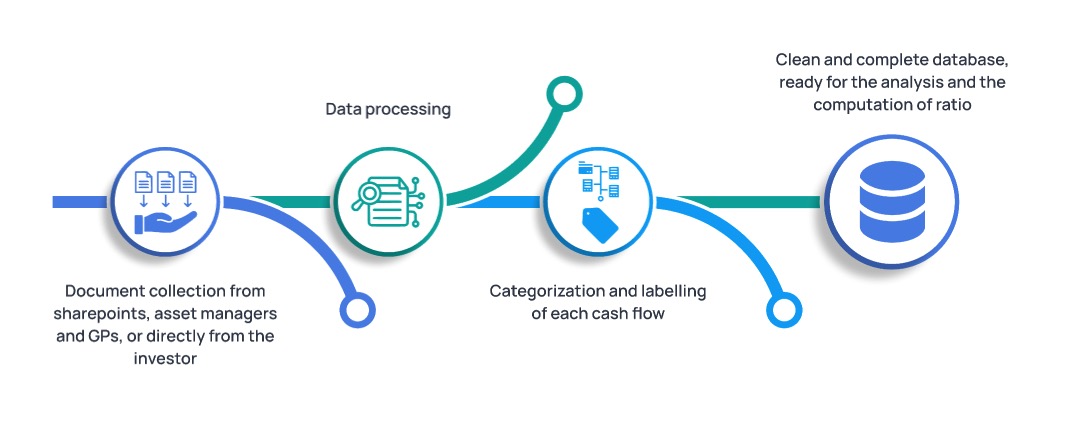

Private market investments are no longer marginal—they are central to long-term strategies. Our mission is to help you onboard all your portfolio assets into a single, coherent reporting ecosystem. Whether you invest in infrastructure, venture capital, private debt, direct private equity deals, or even alternative stores of value like art or forests, Quantilia consolidates and structures this information to the same standard as listed markets. We don’t stop at fund-level data: we track capital flows, assess liquidity, and offer deep lookthrough when possible. This unified view allows asset owners, CIOs, and wealth advisors to manage their private markets allocations with the same clarity and confidence as their public ones.he highest level of data accuracy and reliability. As part of our comprehensive service offerings, we meticulously manage the funds inventory data collection process, ensuring that each piece of information is collected and verified with utmost attention to detail. Our team conducts rigorous checks on each file, performing up to 600 individual checks to validate the integrity and completeness of the data. This extensive validation process allows us to identify and rectify any discrepancies or inaccuracies, ensuring that the final dataset is of the highest quality. Once the data has been thoroughly vetted, our team undertakes the task of cleaning and preparing the data for analysis. This involves standardizing formats, resolving inconsistencies, and eliminating duplicate entries to create a clean, structured dataset. Read More

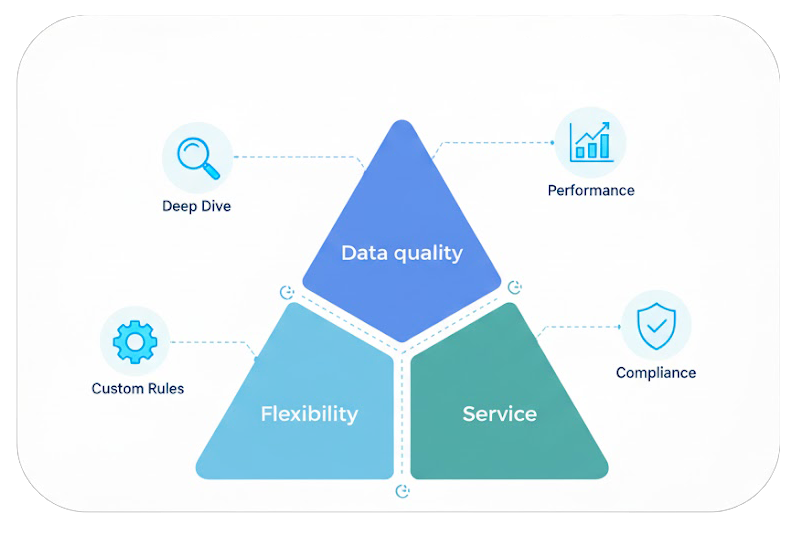

Reliable and Structured Private Market Data

Good decisions require good data. Quantilia combines multiple data sources—capital accounts, GPs, PDFs, custodians—and enriches them through proprietary controls and normalization, so you can act on accurate, structured private markets data.

Asset and Liability Management for LPs and GPs

Balance commitments, capital calls, and liquidity with precision.

Quantilia supports both Limited Partners (LPs) and General Partners (GPs) in managing their private market cash flows. We track commitments, distributions, and unfunded capital while modeling projected inflows and outflows—helping you optimize liquidity and capital deployment strategies.

Lookthrough of PE Funds

Access data beyond the fund level.

We provide transparency into the underlying assets of your private equity funds. This includes communication with GPs and parsing of holdings files for a more granular view.

Liquidity Forecasting

Plan ahead with confidence.

We model future cash flows based on historical transactions, expected IRRs, and investor-specific assumptions. This is especially valuable for portfolio rebalancing and stress testing.

PDF Notice Extraction with AI

Automate data capture from unstructured documents.

Quantilia uses AI and natural language processing to extract key data points—like capital call amounts, dates, and fees—from GP notices. This removes manual steps and increases accuracy.

Our Others Services

ESG Data Integration

Exposure Monitoring

Performance

Custom API

Private Markets: Core of Your Portfolios, Core of Our Analysis

As private markets gain weight in strategic allocations, reporting and transparency must evolve to keep pace. At Quantilia, we’ve built our infrastructure to reflect this shift. We integrate private investments into every level of analysis: from performance metrics and exposure breakdowns to ESG scoring and risk forecasting. We know these assets are often the most complex—but also the most impactful in terms of return and diversification. That’s why our platform treats them not as an add-on, but as a central component. Whether you need support with fund documentation, advanced analytics, or cross-asset consolidation, Quantilia ensures your private markets data works for you—not against you.