Document Generation

Automated, compliant, and custom reporting across all your investment data. Quantilia transforms complex data into clear, structured documents—tailored to each stakeholder’s needs.

Smart Generation

Generate consistent reports in seconds

Clear Reports About Complex Portfolios

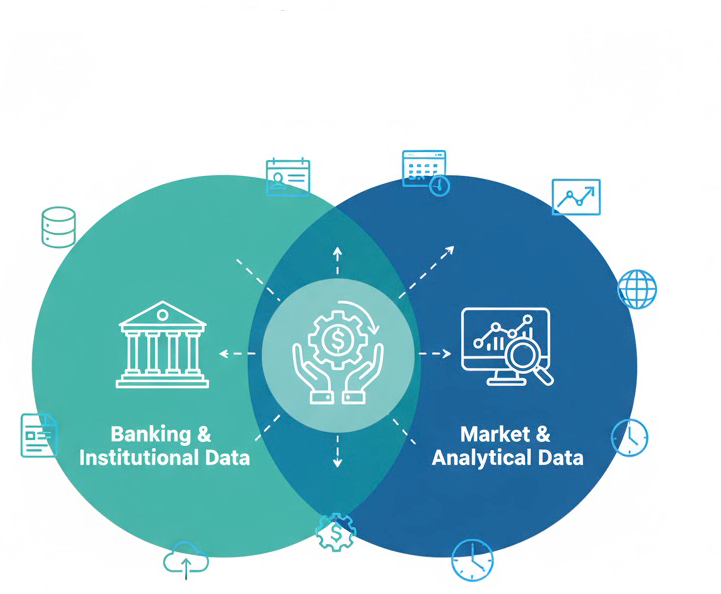

As portfolios grow more diverse and data sources multiply, generating clear and meaningful investment documents becomes increasingly challenging. Whether you’re reporting to clients, regulators, investment committees, or internal teams, each stakeholder expects timely, precise, and easy-to-read outputs. Quantilia makes that possible. Our document generation engine pulls from your aggregated, validated data to create professional-grade reports—automatically, and at scale. We bring consistency across formats, automate tedious tasks, and enable flexible configurations to adapt to various report types. The result: less time spent formatting, and more time focusing on analysis and communication.

Document Generation at Quantilia

Quantilia’s document generation capabilities support a wide range of financial reporting needs:

Monthly or quarterly investment reports for end clients or management

Regulatory templates such as TPT (Solvency II), EET/SFDR, LEC29, and more

PDF and Word files with charts, metrics, and narratives tailored to your layout

Custom Excel files for quantitative teams with formulas and tabular data

Dashboards and web interfaces for real-time access to data extracts

Language and branding personalization for white-label distribution

Workflow automation for recurring publications

Secure delivery via email, portal, SFTP or API

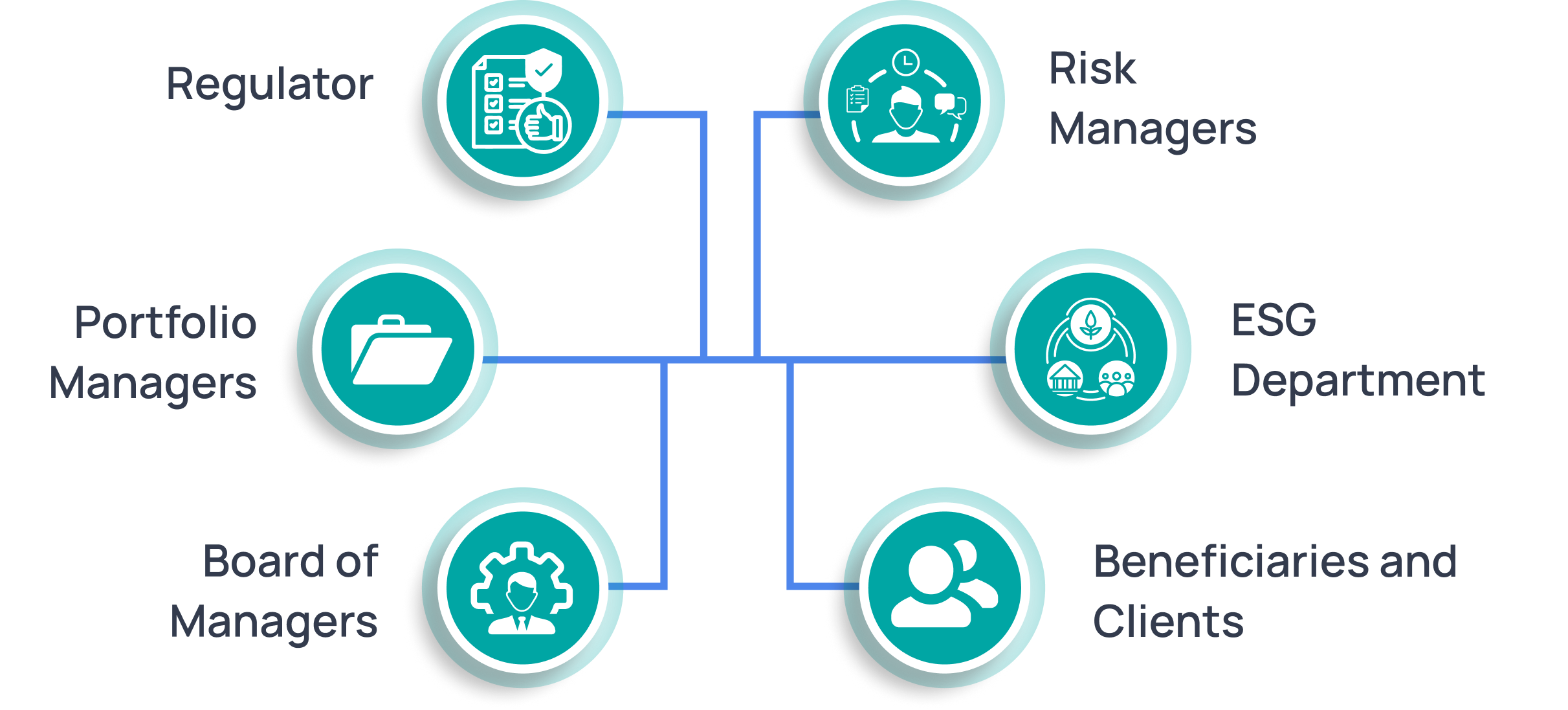

Tailored Reports for Every Stakeholder

Different teams require different views of the same portfolio. A regulator expects specific formats and fields; a client wants simplified summaries and visuals; a risk team needs detailed indicators; an ESG officer monitors alignment with sustainability goals. Quantilia understands these nuances. Our system supports the generation of differentiated reports from the same underlying dataset. You define the audience, frequency, and output style—we take care of the rest. We also support multilingual templates, digital delivery, and version control, making compliance and communication both smooth and scalable.

From Regulatory Templates to Custom Documents

Whether you need standardised templates for regulatory compliance or fully bespoke reports for internal or external use, Quantilia delivers. We help you industrialize your reporting process—without compromising on personalization or data accuracy.

Monthly Portfolio Reports

Keep clients informed with professional-grade summaries.

We generate branded, clear PDF reports showing performance, allocation, and key indicators. Visuals, commentary, and layout are all customized to your style.

Regulatory Reports (TPT, SFDR, LEC29, etc.)

Stay ahead of compliance requirements.

Custom Excel Files for Your Analysi

Provide your team with clean, usable data files.

We generate spreadsheets containing your metrics, formulas, and time series, refreshed at your desired frequency and easily integrated into your internal models.

Web Interface with On-Demand Extracts

Empower teams with dynamic, self-service data access.

Our Others Services

ESG Data Integration

Exposure Monitoring

Performance

Custom API

Your Systems, Our Solutions

We know you already have internal tools, compliance rules, and operational constraints. That’s why Quantilia’s document generation platform is designed to integrate—not disrupt. Whether you rely on internal databases, portfolio management systems, or legacy infrastructure, we adapt to your workflow. Our platform can ingest your data, apply formatting rules, and deliver outputs directly into your systems, folders, or email chains. With secure APIs, automated jobs, and full traceability, we ensure your reports are not only accurate and timely—but also delivered where and how your teams expect them.