Monitor your portfolios with precision and depth.

Our platform adapts to your strategy, offering consolidated views and meaningful analytics across all asset classes.

Precision Insights

Monitor. Analyse. Decide.

Our Vision at Quantilia

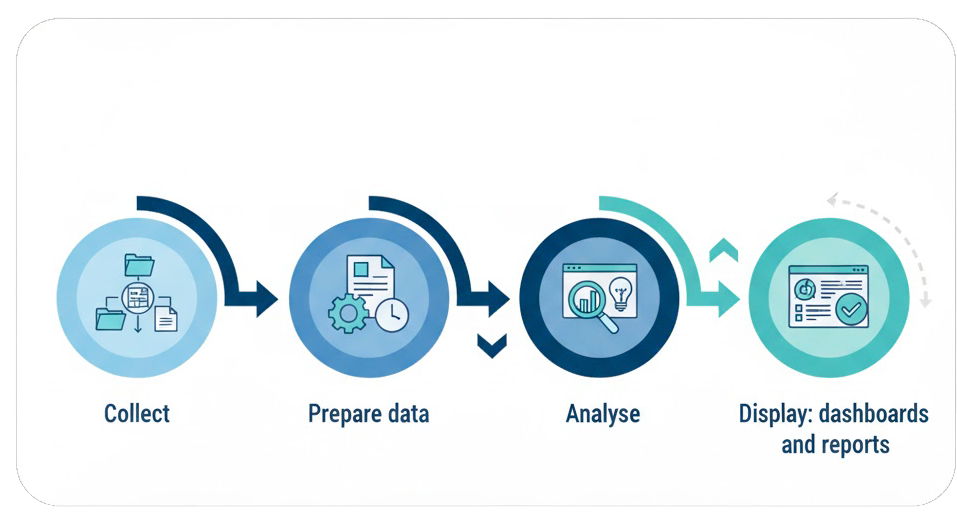

Portfolio monitoring should not be a constraint—it should be a strategic advantage. We believe that investors deserve more than static spreadsheets and limited visibility. Our mission is to empower asset owners and investment professionals with a clear, dynamic, and holistic view of their portfolios.

At Quantilia, we help demanding investors turn complex, fragmented data into clear, actionable insights. Through customizable tools, flexible reporting modules, and seamless integration of all asset classes, we transform raw information into a decision-making asset. Our goal is to give you back control and clarity—so you can focus on your strategy, not your data.

What we cover

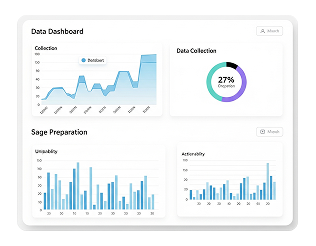

With our tailored portfolio monitoring solution, you gain full visibility on your assets and performance, through a robust and modular infrastructure.

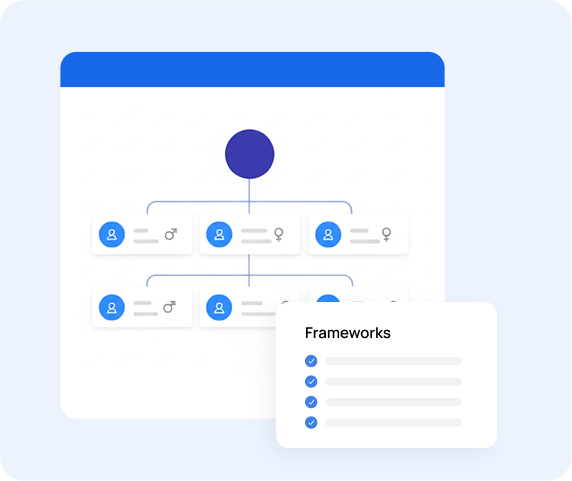

Cross-asset consolidation, including private equity, structured products, and loans

Aggregation of positions from multiple custodians and accounts

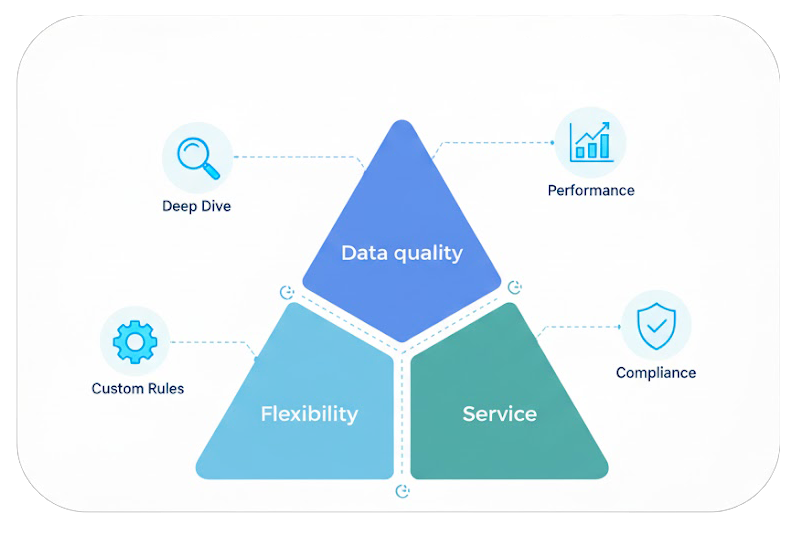

Automated data quality controls and standardization

Multi-level analytics by asset class, sector, geography, etc.

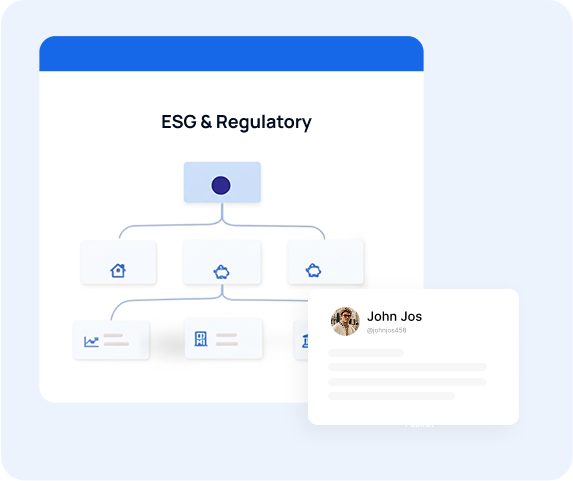

Integration of ESG data, benchmarks, and custom indicators

User-friendly web interface, dashboards, and downloadable reports

API access for system integration and automation

Lookthrough on funds holdings (100% transparency) and much more !

Adapting to Your Needs

Because each client’s structure, data, and objectives are unique, we’ve built our tools to be modular and flexible. You decide what you need, and we’ll configure the right setup with you.

Performance Attribution

Gain clarity on what drives your results.

Dissect your portfolio’s performance by strategy, asset class, or geography. Quantilia allows you to build a meaningful narrative for your stakeholders, backed by clean, consolidated data.

Risk Contribution

Understand where your exposure really lies.

Identify what truly drives your portfolio’s risk. From volatility to conditional VaR, we highlight the most relevant risk dimensions, and how each position contributes.

Private Equity Monitoring

Bring control and foresight to your illiquid holdings.

Track capital calls, distributions, and commitments with advanced cash flow forecasting models. Our tools are designed to handle the illiquidity and unpredictability of PE investments.

Fee Analysis

Make hidden costs visible and actionable.

Understand the true cost of investment and custody across accounts. Quantilia enables transparent, standardized analysis of management fees, retrocessions, and cost impact on net performance.

Our Others Services

ESG Data Integration

Exposure Monitoring

Performance

Custom API

Managing Your Project: A Partnership , Not Just a Tool

From onboarding to daily operations, Quantilia works closely with your team. We assign a dedicated financial expert who knows your context, and ensure smooth integration through regular checkpoints. Each project is managed in phases: needs scoping, technical setup, data onboarding, and run mode—with quarterly reviews and continuous improvement. Our clients enjoy responsive support and a genuine relationship built on trust and results.