AI Services

Artificial Intelligence applied to investment data, reporting, and analysis. Quantilia combines advanced AI tools with financial expertise to power your workflows and unlock new insights.

Adaptive Intelligence

Leverage AI for smarter decisions

AI: A Powerful Tool, Purpose-Built for Financial Analysis

At Quantilia, we develop and apply AI to address concrete challenges faced by investment professionals: extracting information from unstructured files, cleaning raw data from multiple sources, recognizing asset patterns, and navigating large document libraries. We don’t see AI as a replacement for financial logic, but as a tool that enhances it. That’s why our AI models are trained and configured with deep finance-specific knowledge—so the results make sense, and the outputs are ready to use in real-world workflows. Whether you’re managing portfolios, generating reports, or building dashboards, our AI-powered infrastructure boosts efficiency, improves accuracy, and expands what’s possible.

AI at Quantilia

Quantilia’s AI suite delivers scalable automation and insight across key data and reporting functions:

AI-driven data extraction from PDF notices, reports, and investor files

Natural language processing (NLP) to classify and tag financial documents

Automated data cleaning, deduplication, and formatting

Clustering and behavioral grouping of assets using unsupervised learning

Large-scale processing of document libraries (e.g. fund prospectuses, ESG disclosures)

RAG (Retrieval-Augmented Generation) for financial knowledge queries

Use of AI to enrich data sets with external classifications or scores

Human-in-the-loop workflows to validate sensitive outputs when needed

AI and Human Expertise, Combined

We believe in the synergy of powerful algorithms and expert oversight. At Quantilia, all AI workflows are built with embedded quality controls and guided by financial professionals who understand both the data and the decision-making context. Whether parsing GP notices, tagging structured products, or identifying correlations between instruments, we ensure that AI is not acting in a black box. You get the speed and scale of automation, plus the trust and traceability required in financial operations. Our clients benefit from a continuously improving system—because our AI learns, and our experts refine.

From Data to Knowledge: AI’s Many Roles in Finance

AI has numerous applications in the financial industry—from operational automation to portfolio insight. Techniques like Retrieval-Augmented Generation (RAG) allow users to query internal knowledge bases and receive smart, sourced answers—transforming how teams interact with data.

Data Extraction from PDFs

Turn unstructured documents into structured insights.

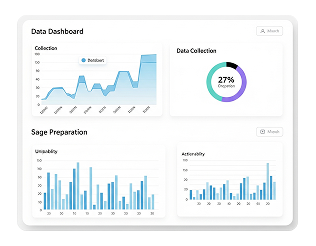

Data Cleaning and Preparation

Automate the boring, improve the accuracy.

Our algorithms detect duplicates, fill missing fields, and align formats across data feeds—creating ready-to-use datasets for performance, risk, or ESG analytics.

Asset Clustering and Pattern Recognition

Group instruments by how they behave, not just how they’re labeled.

AI models analyze correlations, volatility patterns, and price behavior to identify clusters of assets. This helps in diversification analysis and smart allocation strategies.

Library Processing and Search

Unlock your document archive with intelligent search.

We index and structure entire libraries of PDFs or Word files—so you can search by concept, tag content, and retrieve relevant sections instantly using AI-enhanced search logic.

Our Others Services

ESG Data Integration

Exposure Monitoring

Performance

Custom API

AI Is Changing Everything — We’re Making It Work for You

AI is reshaping how financial institutions operate—and at Quantilia, we’re not just watching it happen. We use AI internally to power our own workflows, and we make those same tools available to our clients. Whether you’re a family office trying to extract clean data from old reports, or an insurer seeking smarter risk classification, we help you implement AI where it matters. And we do it responsibly—with traceability, oversight, and results you can trust. Quantilia gives you access to cutting-edge technology, combined with the financial intelligence needed to make it work in your world.