ESG and Risk Reports

Meet your regulatory obligations with confidence and precision. Quantilia produces compliant, high-quality ESG and legal reports for financial institutions, regulators, and end clients.nvestments. Our platform offers security-level look through for unmatched portfolio transparency.

Responsible Reporting

Measure impact. Ensure full compliance.

Reports for Your Regulator and Other Stakeholders

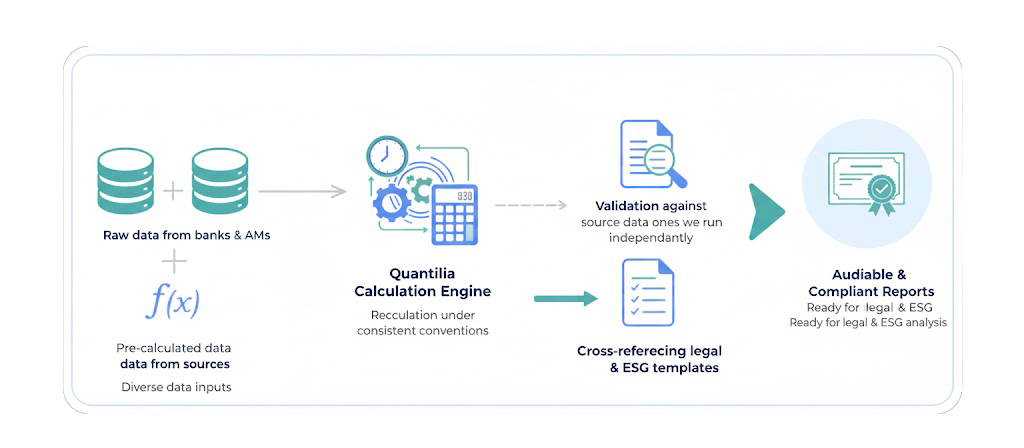

The regulatory landscape is evolving fast—SFDR, MiFID, PRIIPs, CRR2, and Solvency II are no longer just acronyms, but core reporting frameworks for today’s investment world. Investors must deliver precise, timely, and auditable reports to regulators, distributors, and clients, all while managing complex multi-source data. Quantilia bridges that gap. We automate the generation of all major European reporting templates—FinDatEx formats like TPT, EET, EMT, EPT—as well as climate disclosures, DICs (PRIIPs), and Basel III / CRR2 reporting. Whether you manage internal mandates or external funds, our platform ensures that your reports meet formatting requirements, pass validation checks, and reflect the latest regulatory updates.

Risks and ESG reports at Quantilia

Our ESG and Legal Reporting solution helps you automate your regulatory disclosures with high reliability and full auditability:

Generation of FinDatEx templates: TPT (Solvency II), EET (SFDR), EMT (MiFID), EPT (PRIIPS)

Solvency II compliance: SCR calculations, asset classification, risk factors

ESG regulatory reporting: SFDR, PAI indicators, LEC29, climate and emissions data

Basel III / CRR2 reports for banks and investment firms

Prospectus data and DIC PRIIPs generation based on fund characteristics

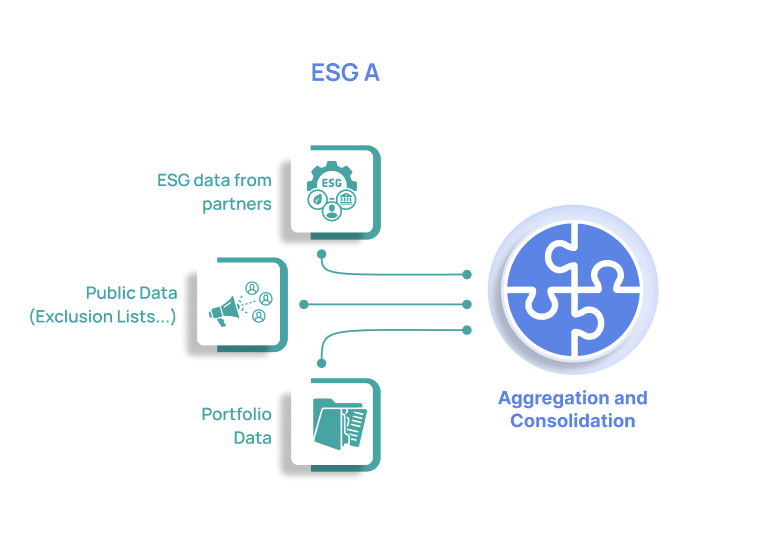

Data collection from custodians, GPs, and ESG providers

Pre-validation of fields and full error reporting to speed up delivery

Export formats ready for regulator upload or client communication

Quantilia: Reliable Data, Reliable Report

Your reports are only as good as the data behind them. At Quantilia, we ensure both the integrity and traceability of every data point used in your legal and ESG reports. Our platform starts by collecting structured and unstructured data from your multiple sources: custodians, asset managers, fund administrators, ESG vendors, and more. We apply automated validation checks, reconcile inconsistencies, and enrich the data with reference metrics—like taxonomy tags, country classifications, or ESG scores. Each report is logged, timestamped, and backed by a full audit trail, giving you full confidence when submitting to regulators or distributing to clients. With Quantilia, your reporting is not just compliant—it’s resilient and future-proof.

A Wide Spectrum of Reporting Templates

From Solvency II and Basel III to SFDR and PRIIPs, Quantilia supports all key regulatory and ESG frameworks. Our modular architecture lets you activate the formats you need, with regular updates to reflect regulatory changes.

Solvency II and SCR Reports

Streamline your solvency reporting process.

We calculate SCR figures, risk-weighted exposures, and generate the TPT file using validated lookthrough and asset-level data. These are adapted to the specifics of your portfolio and updated monthly or quarterly.

ESG Regulatory Reports

Respond to SFDR and PAI requirements with confidence.

Our platform collects ESG metrics, applies client-specific exclusions or thresholds, and generates compliant EET files, SFDR templates, LEC29 dashboards, and emissions reports.

Thresholds and Limits Monitoring

Monitor and alert on regulatory constraints.

We help track concentration limits, ESG alignment thresholds, or eligibility ratios in real time—before they become reporting issues. Alerts and custom dashboards make this process proactive, not reactive.

Custom Reports for Stakeholders

Create personalized, audit-ready reports.

Whether for end-clients, board meetings, or internal compliance teams, we generate bespoke reporting packs using your own metrics, visual formats, and content structure.

Our Others Services

ESG Data Integration

Exposure Monitoring

Performance

Custom API

One Project Manager Who Speaks Your Language

At Quantilia, you’re never left to figure things out on your own. We assign you a dedicated project manager—someone with real experience in finance and reporting—who understands your regulatory environment, your asset structure, and your deadlines. This person works with you from onboarding to run mode, handling technical coordination, validations, and iterations. You get a responsive, expert partner who ensures that your ESG and legal reports are always delivered on time, in the right format, and with the right level of oversight. At Quantilia, it’s not just about ticking boxes—it’s about supporting your reporting strategy, long term.