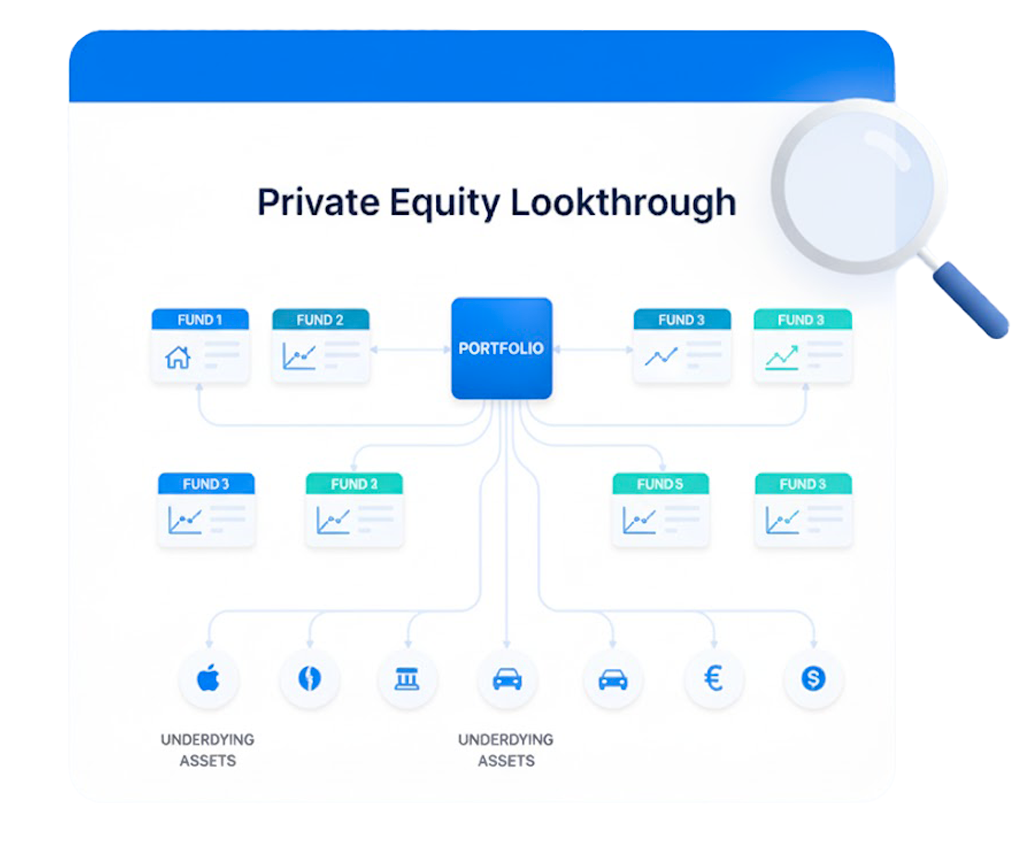

Private Equity Lookthrough

Achieve full transparency into your private equity and private market holdings. Quantilia automates lookthrough analysis to help you access, structure, and validate granular investment data.

Deep Transparency

See through layers of private capital

The Lookthrough Expert Across Asset Classes

From private equity funds to structured products and fund-of-funds, Quantilia has become a reference in lookthrough reporting. We help institutional investors and family offices extract security-level insights—even when the data is fragmented, delayed, or unstructured.

Private Equity Lookthrough at Quantilia

Our Private Equity Lookthrough solution gives you clear, validated access to underlying investments held through private market vehicles:es a mix of qualitative expertise and quantitative tools. Quantilia assist large investors for the latter, providing innovative and accurate quantitative analytics:

Collection and parsing of holding files from GPs, administrators, and custodians

Legal setup to ensure data sharing and compliance with GPs

Security-level breakdown of fund inventories across asset classes

Data quality controls, consistency checks, and alerts for anomalies

Enrichment with public and proprietary data (ESG, sector, geography)

Monthly updates and audit trails for traceability

Dashboards and exportable reports for stakeholders or regulators

Coverage across fund-of-funds, co-investments, secondaries, and direct holdings

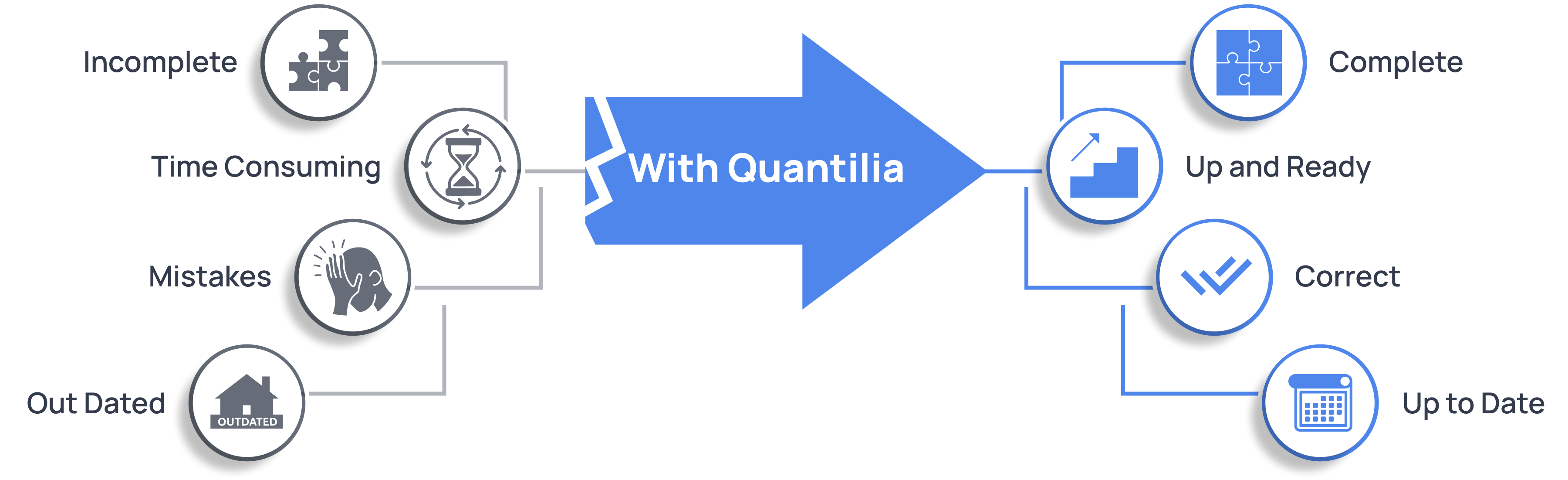

Our Mission: Data Quality at the Core

Lookthrough reporting is only as valuable as the data it’s built on. At Quantilia, our mission is to ensure that every data point—from GP files to security-level positions—is consistent, enriched, and audit-ready. We implement a multi-step quality control process: completeness checks, internal consistency testing, benchmark cross-verification, and tagging of outliers or missing values. Enrichment is done using external databases and our in-house classifications, to bring added clarity to each position (e.g. asset class, sector, ESG). All files, transformations, and alerts are logged for transparency and compliance audits. With Quantilia, you don’t just see through your private equity funds—you trust the data you’re seeing.

Comprehensive Coverage Across Private Market Sub-Asset Classes

Our lookthrough capabilities extend beyond traditional private equity. We actively support transparency for private debt, venture capital, infrastructure, real estate, and hybrid funds—offering unified access across your alternative investment universe.itutional investors. From advanced portfolio breakdowns to bespoke regulatory reports, our solutions adapt to your specific strategy, structure, and compliance needs.

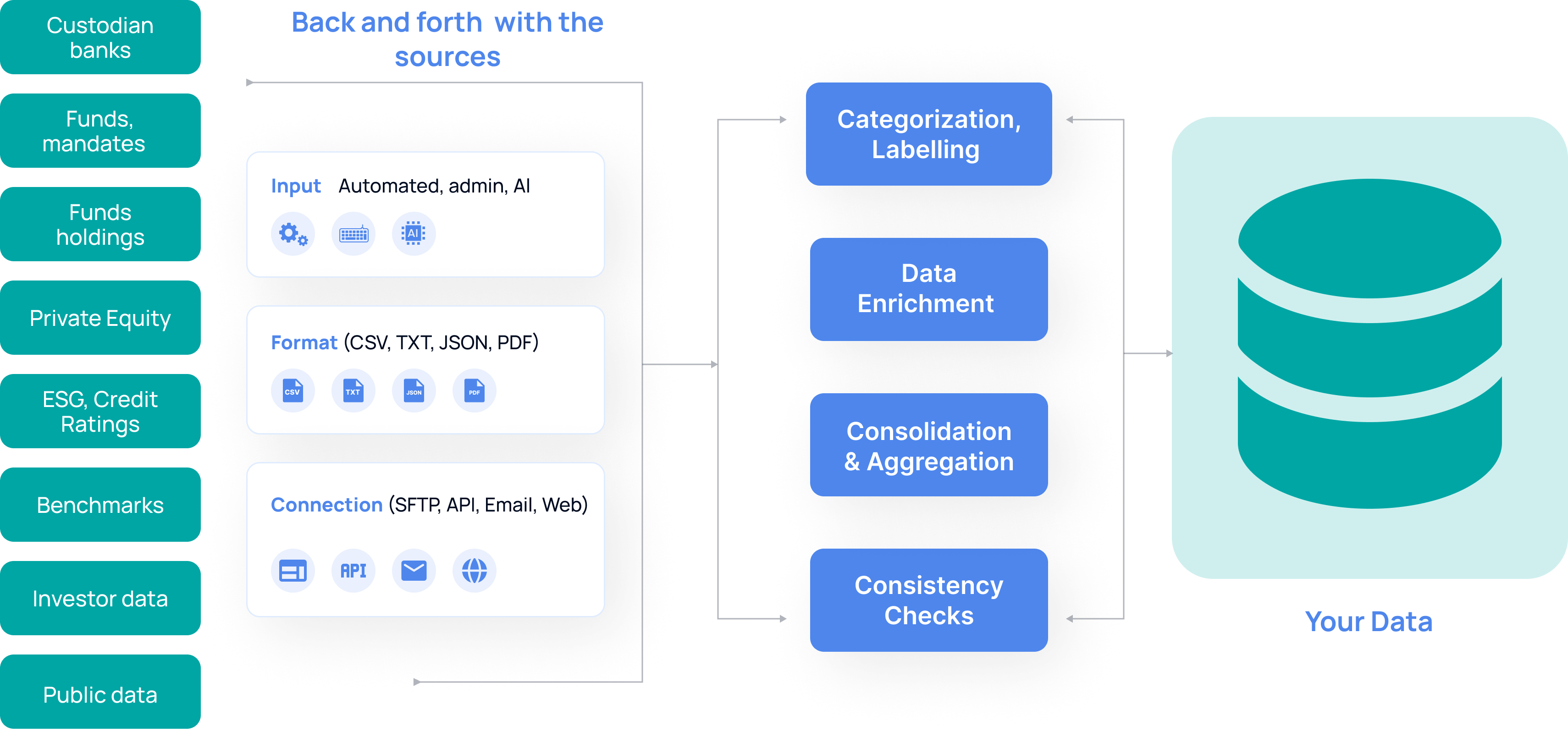

Collect and Structure Lookthrough Data

Turn raw fund inventories into usable data.

We retrieve and process holdings files from GPs, administrators, or custodians. Quantilia structures the content into clean, standardized data ready for analysis and reporting.

Automated Data Quality Checks

Trust your data with confidence.

Our system performs multiple layers of validation, including internal consistency rules, missing value alerts, and benchmarking. This reduces manual checks and ensures reliable reporting.

Tailored Lookthrough Reports

Deliver insights that match your internal and external needs.

Whether it’s for regulatory filings, client presentations, or investment committee reviews, Quantilia builds customized reports that align with your format, frequency, and content expectations.

One-Stop Shop for Private Market Reporting

Consolidate your alternatives into a single platform.

We combine lookthrough with commitment tracking, liquidity modeling, and ESG scoring—making Quantilia your comprehensive solution for private market visibility and reporting.

Our Others Services

ESG Data Integration

Exposure Monitoring

Performance

Custom API

Designed to Fit Your PE Team Workflow

Quantilia adapts to the unique way your private equity team works. Whether you receive PDFs, Excel files, or database feeds, we integrate seamlessly into your operational processes. Our onboarding includes a detailed scoping of your data sources, reporting needs, and internal systems. From there, we automate the ingestion, cleaning, and delivery of lookthrough data—whether through dashboards, report packs, or direct integration via API or secure file exchange. Your team saves time, avoids errors, and keeps full control over how data is used internally or presented externally.