Advanced Portfolio Analytics for investment teams, built on clean and complete data.

Quantilia empowers your quant models and reporting needs across asset classes and risk factors.

Analytical Depth

Transform data into actionable insight

Our Quantitative Vision

At Quantilia, we believe data science and portfolio management go hand in hand. Our platform offers powerful, ready-to-use quantitative analysis tools while remaining flexible enough to support custom risk and performance models. Whether you’re a quant, a risk officer, or an asset allocator, our infrastructure is here to serve your logic—not impose one.

Quant Analysis at Quantilia

Our quantitative analysis engine helps investors scale their analytical capabilities, automate risk metrics, and focus on high-value strategic tasks:

Time series analytics, risk decomposition, and cross-portfolio factor analysis

Automated preparation of numerical indicators: drawdowns, volatilities, correlations, beta exposures, etc.

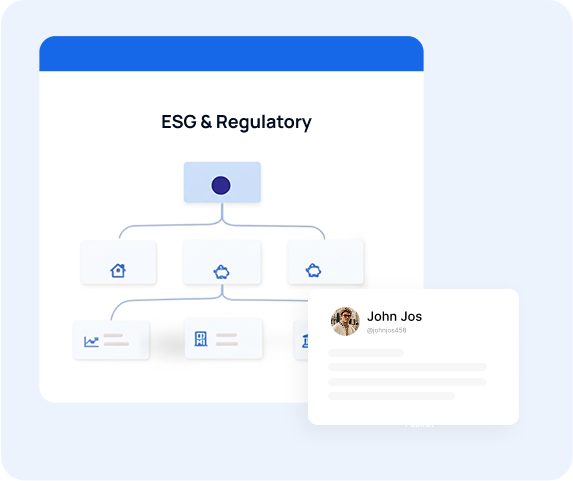

ESG data integration and weighting for advanced sustainability metrics

Integration of Private Equity forecasting and ratios into overall analytics

Calculation of solvency ratios and regulatory indicators (e.g., Solvency II SCR)

Smart grouping of instruments (clustering) by behavior or performance

Support for custom metrics or models using proprietary formulas

API and exports for integration into internal quant or reporting systems

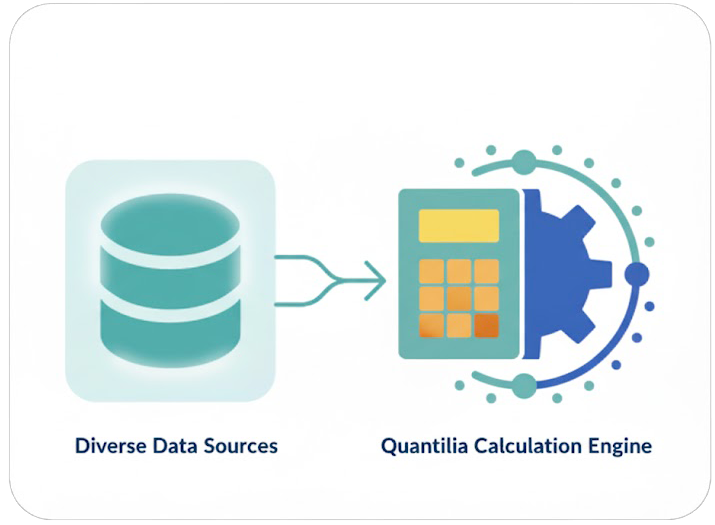

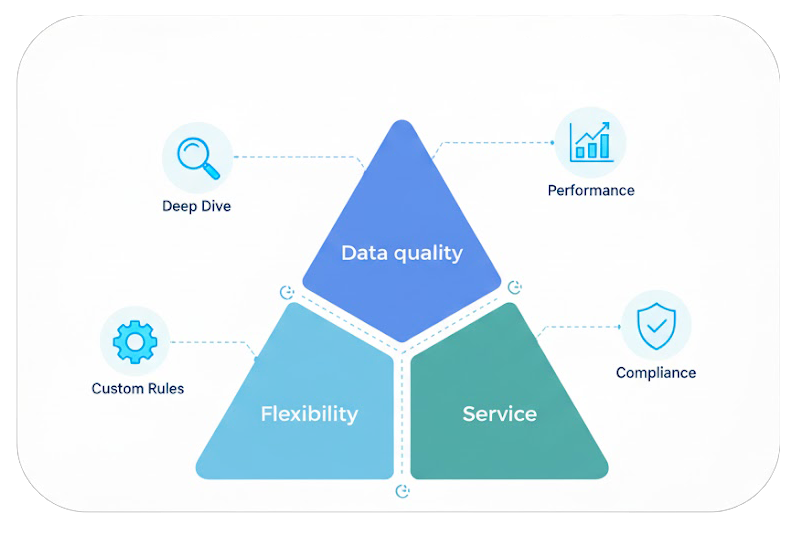

Our DNA: Quantitative Models Grounded in Data Quality

Quantilia was born from a strong quantitative background—our founders come from elite academic and financial institutions, with deep expertise in stochastic modeling, structured finance, and asset allocation. This quant DNA is reflected in every layer of our platform. We know that the best models are only as good as the data behind them. That’s why we focus on data structuring, enrichment, and validation before any analytics occur. Our pipelines are built to clean and standardize complex data sets—across custodians, asset managers, and instruments—so that your outputs are robust and comparable. From statistical indicators to proprietary metrics, all our computations rest on a foundation of trusted, high-quality data.

Empowering You as a Quant

Our role is not to replace your models—but to provide you with the tools, data, and structure you need to build better ones. With Quantilia, quants and analysts work faster, iterate more, and unlock the full potential of their strategies.

Private Equity Liquidity Analysis

Anticipate liquidity gaps in illiquid portfolios.

Using historical cash flows, capital calls, and commitments, we simulate future outflows and liquidity needs for private equity allocations. This supports ALM, scenario testing, and strategic planning.

SCR & Regulatory Calculations

Automate Solvency II and CRR2 metrics with confidence.

We help insurers, pension funds, and financial institutions compute regulatory ratios including Solvency Capital Requirement (SCR), CRR2 risk-based capital ratios, DIC PRIIPs indicators, and pre-contractual SFDR documents. Our platform ensures data standardization, traceability, and compliance-ready outputs.

Clustering of Assets

Group investments by behavior, not just labels.

Through correlation and performance similarity, we dynamically cluster instruments into behavioral groups. This enables better diversification analysis and innovative allocation strategies.

Custom ESG Analysis

Transform your ESG policy into tangible metrics.

Quantilia supports fully customizable ESG frameworks, whether based on exclusions, scores, thresholds, or label tracking. We plug in external or internal data sets and build personalized dashboards and reports aligned with your sustainability goals.

Our Others Services

ESG Data Integration

Exposure Monitoring

Performance

Custom API

Adapting to Your Quant Projects: From Logic to Execution

Every quant project starts with a hypothesis, a model, or a need—and at Quantilia, we help bring it to life. We begin with a technical and business scoping phase, where we understand your logic and constraints. Then, we configure data flows, build the necessary indicators or APIs, and test outputs in sandbox mode. You interact with a team that understands both finance and computation, allowing fast iterations and long-term reliability. As your models evolve, we adjust the pipeline—without breaking your reporting or internal processes. Whether you’re testing new risk factors, refining an ESG framework, or industrializing analytics for stakeholders, Quantilia scales with your ambition.