Product Details

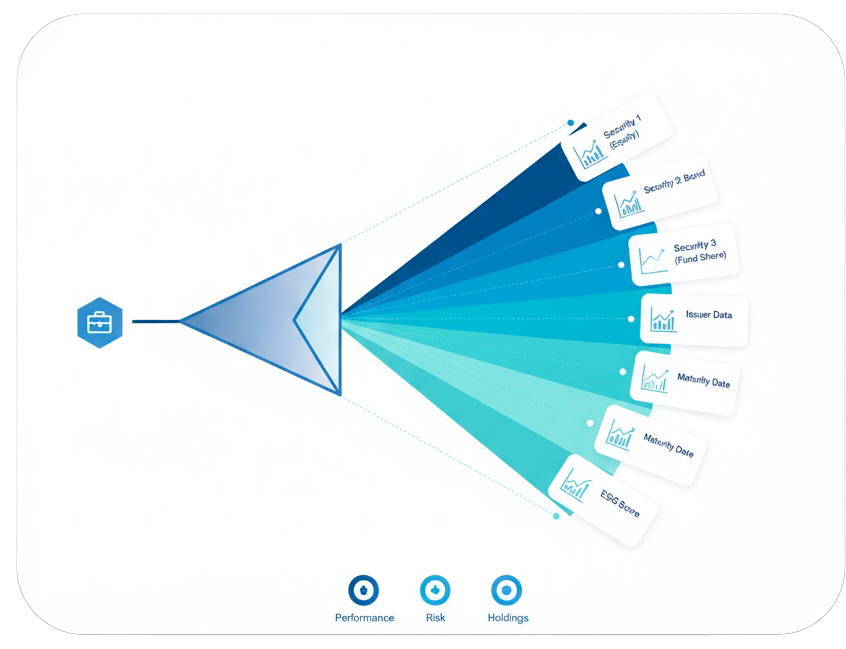

Security-Level Lookthrough

Gain complete visibility into every layer of your investments. Our platform offers security-level look through for unmatched portfolio transparency.

Full Transparency

See every holding, across layers

The DNA of Quantilia

Quantilia has a team of data engineers quantitative with extensive banking experience investment and asset management. In this context, Quantilia performs quantitative R&D continuously, and constantly enriches the possibility for its clients to benefit from the best data granularity and detail depth. Quantilia lookthrough (or security-level transparency) enables investors to rebuild its portfolio issuer by issuer, aggregating each position from all funds, mandates and direct positions.

Funds and Mandates Lookthrough

Managing a portfolio of funds with medium to long term objectives requires a mix of qualitative expertise and quantitative tools. Quantilia assist large investors for the latter, providing innovative and accurate quantitative analytics:

1

Overlap analysis and funds inventory deep dive

2

Aggregation of funds, mandates and direct positions

3

Consolidation by sub-portfolio, countries, sectors,...

4

Integration of ESG data at the issuer level

5

Liquidity analysis at the fund level

6

Financial data integration at the issuer level

7

Liquid and illiquid asset portfolio lookthrough consolidation

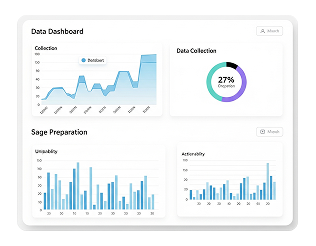

Data Collection and Preparation

At Quantilia, our dedicated team is committed to providing investors with the highest level of data accuracy and reliability. As part of our comprehensive service offerings, we meticulously manage the funds inventory data collection process, ensuring that each piece of information is collected and verified with utmost attention to detail. Our team conducts rigorous checks on each file, performing up to 600 individual checks to validate the integrity and completeness of the data. This extensive validation process allows us to identify and rectify any discrepancies or inaccuracies, ensuring that the final dataset is of the highest quality. Once the data has been thoroughly vetted, our team undertakes the task of cleaning and preparing the data for analysis. This involves standardizing formats, resolving inconsistencies, and eliminating duplicate entries to create a clean, structured dataset. Read More

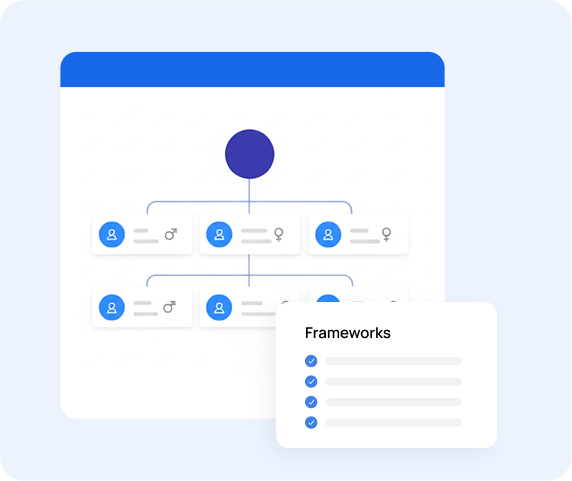

Tailored Data & Reporting Solutions

Quantilia delivers customizable data sets and reporting tools designed for institutional investors. From advanced portfolio breakdowns to bespoke regulatory reports, our solutions adapt to your specific strategy, structure, and compliance needs.

Custom Reporting Frameworks

Build Reports That Match Your Strategy

Whether for internal analysis, client communication, or regulatory submissions, Quantilia enables you to configure every report layout, metric, and data flow according to your organization’s unique needs.

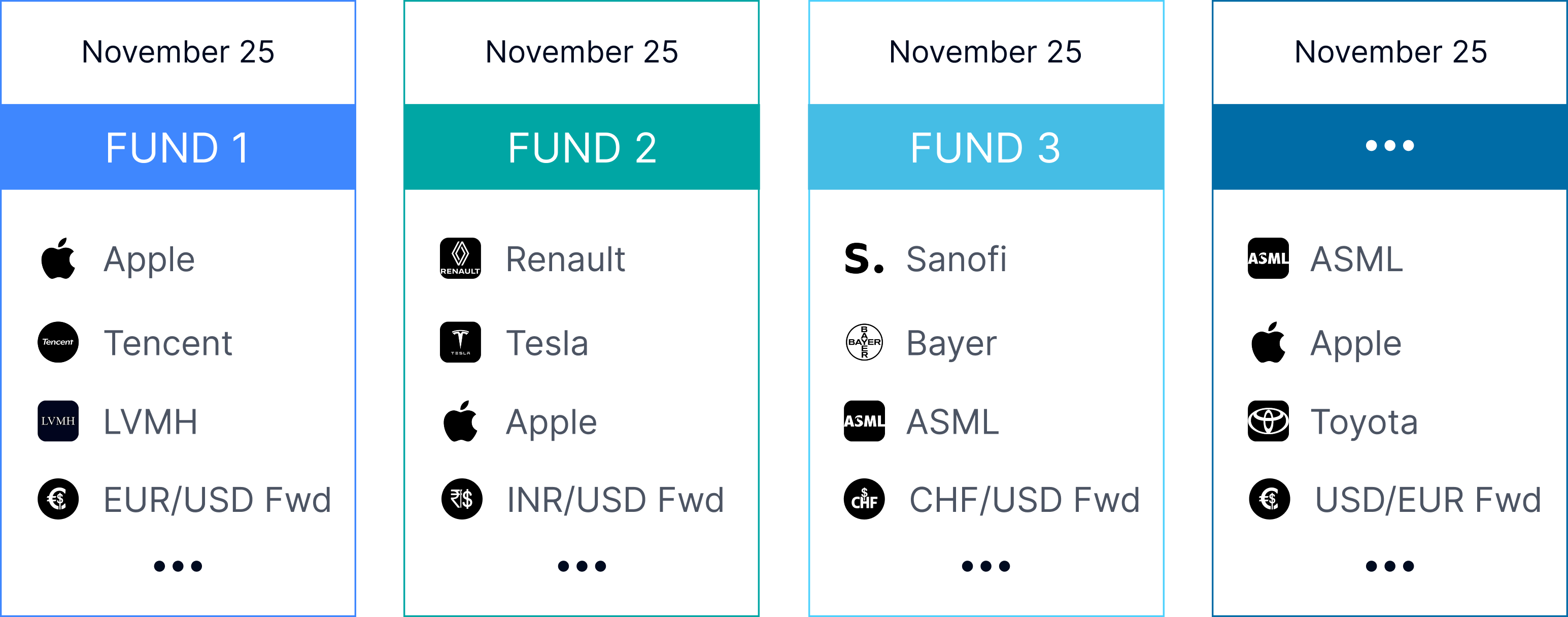

Granular Look-Through Data

Transparency Down to the Security Level

Access security-level insights across all mandates, funds, and direct positions. Quantilia’s platform consolidates positions and rebuilds portfolios issuer by issuer—ensuring total data clarity.

Dynamic Dashboards & Visuals

Interactive Tools for Informed Decisions

Use real-time dashboards with customizable filters and visualizations to track performance, risk, and exposure. Empower your teams to explore and present data without depending on static Excel files.

ESG & Regulatory Compliance Reporting

Stay Ahead of Evolving Requirements

Generate tailored reports aligned with SFDR, CSRD, and other evolving ESG standards. Our platform supports the integration of ESG metrics and provides ready-to-share formats for auditors and regulators.

Our Others Services

Beyond data consolidation and portfolio transparency, Quantilia offers a range of advanced services to support institutional investors with deep insights, operational efficiency, and compliance-readiness.

ESG Data Integration

Integrate ESG metrics from leading providers or your own sources. Quantilia helps you monitor ESG alignment, assess impact, and report against global standards like SFDR or CSRD.

Exposure Monitoring

Track market, credit, and issuer-level risks across all positions. Identify exposures in real time to ensure compliance with internal thresholds and regulatory limits.

Performance

Break down portfolio performance by sector, asset class, region, or issuer. Our advanced tools support in-depth performance attribution and strategic reporting.

Custom API

Access your data where you need it—via custom APIs, secure FTP, or direct platform access. We adapt to your ecosystem, ensuring fast, automated, and reliable data delivery.

Consolidation of Data Sources

Whether utilizing public databases, proprietary benchmarks, or ratings, our platform is designed to seamlessly collect and aggregate data from a wide range of sources to suit your portfolio needs. Our dedicated team is adept at navigating the legal and technical complexities involved in data collection, ensuring compliance with regulatory requirements and safeguarding the integrity of your data. Leveraging cutting-edge technology and robust data management processes, Read More