Automated Lifecycle Tracking for structured products, from issuance to maturity.

Quantilia provides the visibility, accuracy, and control needed to manage structured products with confidence.hed portfolio transparency.

Structured Clarity

Bring transparency to complex payoffs

Our Approach to Structured Products

At Quantilia, we view structured products not as exceptions, but as assets that deserve the same level of automation and precision as more traditional investments. With our expertise in handling complex payoffs, multi-asset underlyings, and event-driven features, we enable full transparency throughout the product lifecycle.

Our approach to Structured Products

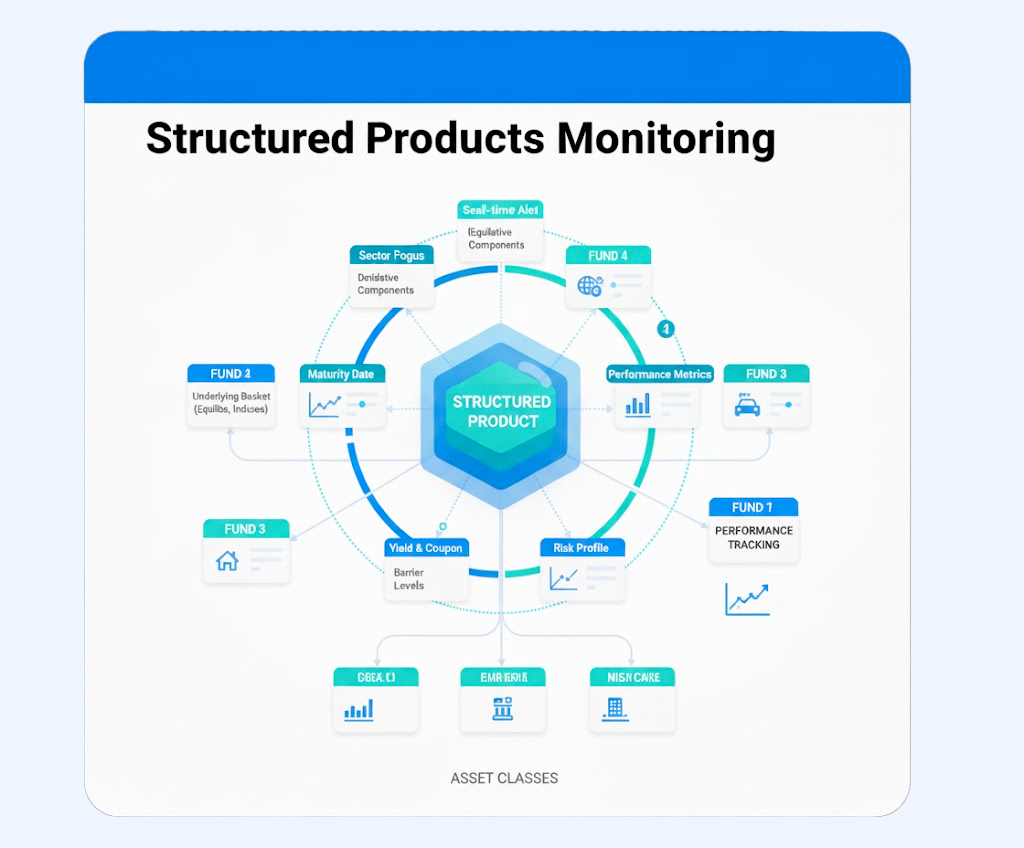

Our structured products monitoring module was built to address the challenges faced by asset owners and wealth managers when tracking these instruments across custodians and banks:ix of qualitative expertise and quantitative tools. Quantilia assist large investors for the latter, providing innovative and accurate quantitative analytics:

Centralized view of structured products across all portfolios

Automatic extraction and standardization of termsheet data

Monitoring of product features: barriers, coupons, redemption events

Alerts for events such as barrier breaches or upcoming maturities

Tracking of coupon payments, accruals, and missed payments

Integration with the overall portfolio risk and performance analysis

Lifecycle status and history for audit and reporting purposes

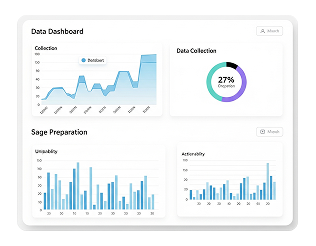

Clean interface and exportable data for reporting or reprocessing

Lifecycle Management: A Core Feature

Structured products follow a dynamic and event-driven path, and our solution is built to reflect that. From issuance to final redemption, Quantilia’s platform ensures complete lifecycle management. We parse termsheets to extract relevant triggers—barrier levels, observation dates, coupon rules—and track them over time against market data. At each stage, whether it’s autocall potential, coupon accrual, memory effect, or capital protection level, the system updates status in real-time. Alerts are triggered when specific thresholds are met or breached, and historical logs are stored for audit and client communication. This structured product lifecycle engine saves you time, reduces manual errors, and gives peace of mind—especially when handling multiple products with diverse structures. It integrates natively with your broader reporting, making structured products no longer an isolated pain point but a fully integrated asset class in your portfolio view.

Tailored to Your Products

Whether your products are linked to equities, FX, rates or hybrids—capital guaranteed, autocallable, or custom structured—our system adjusts to match their architecture. Quantilia’s team helps configure the tracking logic and event flags specific to your instruments.

Coupons and Payments

Track expected and received payments across portfolios.

We monitor memory coupons, digital payouts, and conditional payments automatically. You get a clear view of what has been paid, what’s due, and what’s at risk.

Barrier Monitoring

Be notified when critical levels are approached or breached.

Our engine tracks market data to assess barrier conditions in real time. You receive alerts and can easily report on all impacted products.

Scenario Analysis

Simulate product outcomes under different market paths.

Use our modeling tools to test what would happen under various underlying asset scenarios. This helps support strategic decisions and client communication.

Termsheet Data Extraction

Stop losing time with manual product input.

We parse structured product documentation to extract key terms into a clean, usable format. This ensures consistency across systems and better monitoring throughout the lifecycle.

Our Others Services

ESG Data Integration

Exposure Monitoring

Performance

Custom API

Structured Onboarding for Complex Products

Implementing structured product monitoring requires careful setup, and that’s where Quantilia’s team excels. We begin with a discovery phase to understand the product types, data sources, and reporting needs specific to your activity. Our experts assist with termsheet ingestion, define observation and payoff rules, and configure the interface for your operational teams. Throughout the process, we maintain regular calls and shared workspaces to ensure clarity and progress. Once live, you benefit from a responsive support team, continuous improvements, and proactive monitoring. With Quantilia, structured products become fully manageable—no longer a blind spot in your reporting or a manual burden for your teams.